New paper published in Nature Energy estimating the “renewables pull”

📄💡 New paper published in Nature Energy estimating the “renewables pull” for green value chains of basic materials (steel & chemicals)!

Key insights:

- Substantial cost-savings of 18% for low-carbon steel and up to 38% for low-carbon chemicals when relocating production away from renewables-scarce (eg Germany, Japan, S.Korea) and towards renewable-rich regions (eg Australia, Namibia, Chile).

- Importing green H₂ via ship will be a costly option for conserving existing production locations

- Importing intermediate products (sponge iron, ammonia, methanol) could be a “sweet-spot” of relocation: reducing cost effectively while conserving value chains in renewable-scarce industrial countries

- Relocating the first industrial processing step in H₂-based green value chains to renewable-rich regions could be a global win-win-win scenario for importers, exporters, and climate — but also entails risks (structural changes, false reliance on future imports, import dependencies, resource shuffling, and neocolonial structures)

Read online (open access): nature.com/articles/s41560-024-01492-z

As the world transitions to net-zero emissions, the cost and availability of renewable electricity and green H₂ will increasingly become key locational factors for energy-intensive industries, especially for steel and chemicals. This could result in a global restructuring of existing production and trade patterns of basic materials.

The incentive to relocate production to regions with ample sun, wind, and space is called the “renewables pull” (Samadi et al, Wuppertal). If this incentive effectively induces such relocation, we refer to it as “green relocation” (some call it “green leakage”, but this has a strong negative connotation, whereas we prefer to have a balanced debate about opportunities and risks).

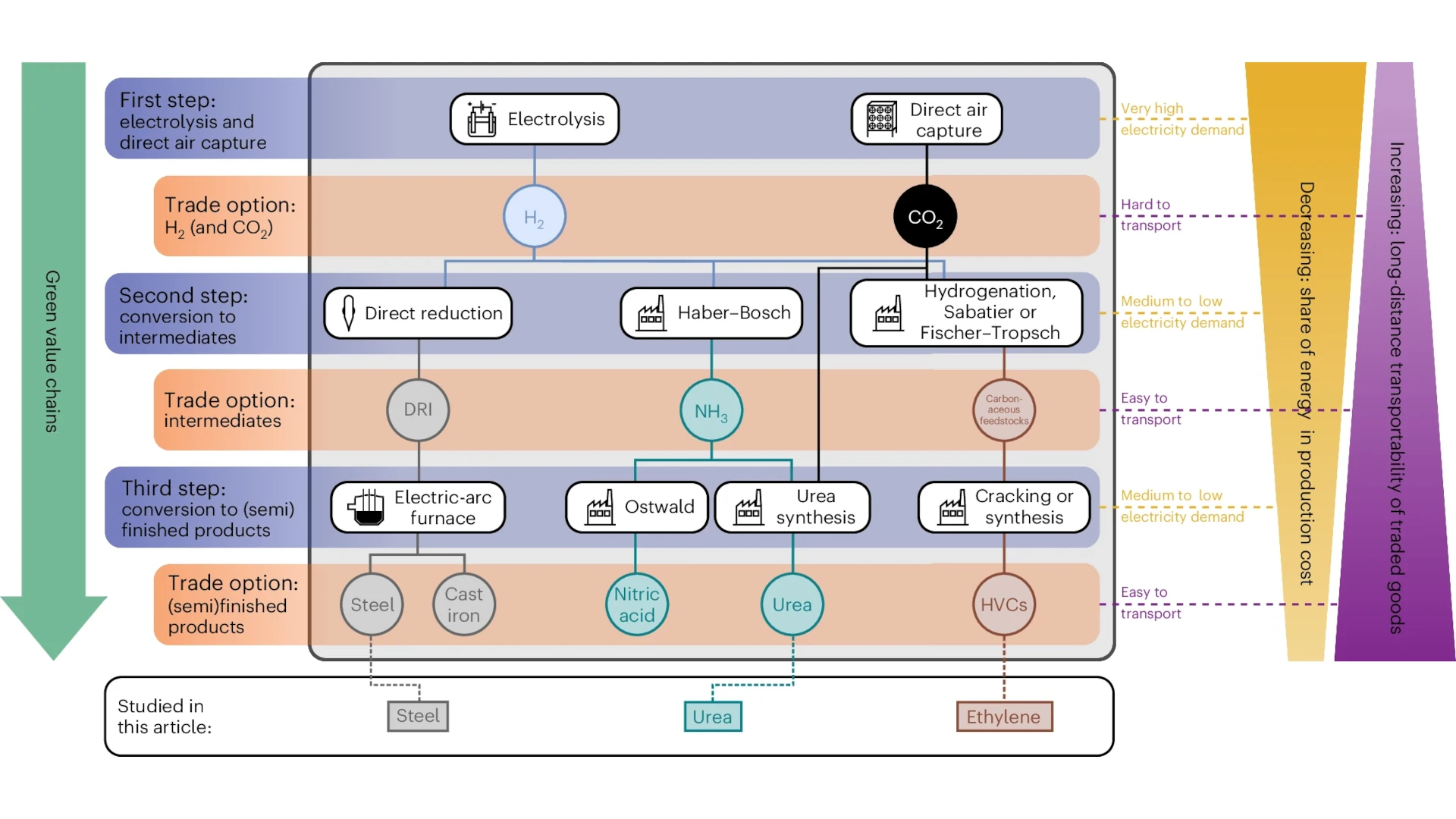

We study the role of the renewables pull in emerging green value chains in the steel and chemical sectors that rely on green H₂, where multiple options for trade are possible. This means that there can be a varying “depth” of relocation.

Production costs decrease with every step relocated. Notably, importing green H₂ via ship is rather costly (due to inefficient H₂ transportation) and doesn’t effectively harness the cost-saving potentials of green relocation. Instead, we can identify the import of intermediate products (sponge iron/DRI, ammonia, methanol) as “sweet-spots” of relocation: production cost can be saved effectively, while existing industrial value chains may otherwise remain as they are.

Our results crucially depend on the difference in electricity prices between renewable-scarce and renewable-rich locations. We show our results for a difference of 20–70 EUR/MWh, while arguing that a difference of 40 EUR/MWh between countries with limited RE potentials (like Germany) and countries with good potentials (like Australia) seems plausible.

Of course renewable energy isn’t the only relevant locational factor for energy-intensive industries. We list other factors that may become important and organise these in three layers:

- Private sector (businesses & markets): What factors would determine investment decisions of companies in the absence of policy intervention (eg supply-chain reliability, value chain integration, existing customer relationships)?

- Regulatory interventions (public policies & strategies): What additional incentives could be created through existing or expected policies (eg IRA in USA, IPCEIs in EU)?

- Societal perspective (goals & trade-offs): How might policymakers try to steer green relocation in future given competing goals (cost efficiency, macroeconomic impacts, geopolitical dependencies, climate targets)?

Ultimately, we find that relocating only the first step of industrial production in H₂-based green value chains to favourable regions for renewables could be a win-win-win scenario: importers could lower transformation cost, energy prices, and downstream production cost; exporters could reap the benefits of industrialisation; and the net-zero transition could be accelerated through an efficient use of global renewables potentials and global spill-over effects for low-emissions industrial technologies.

But there are also risks: macroeconomic losses, false reliance on future imports, and import dependencies for importing countries, and resource shuffling and neocolonial structures for exporting countries.

We are publishing an interactive webapp alongside the paper, which allows users to reproduce all figures under modified assumptions: interactive.pik-potsdam.de/green-value-chains